Si buscas

hosting web,

dominios web,

correos empresariales o

crear páginas web gratis,

ingresa a

PaginaMX

Por otro lado, si buscas crear códigos qr online ingresa al Creador de Códigos QR más potente que existe

Tax withholding guidelines for contract services

04 Mar 15 - 20:17

Download Tax withholding guidelines for contract services

Information:

Date added: 05.03.2015

Downloads: 485

Rating: 411 out of 1401

Download speed: 28 Mbit/s

Files in category: 118

Feb 23, 2005 - Income tax; Government publications. Types of contractual arrangements or agreements . may not be subject to the Regulation 105 or Part XIII withholding requirements, they may consult with a tax services office (TSO).

Tags: services guidelines contract withholding for tax

Latest Search Queries:

hospital pharmacy mission statement

contract attorney blog

lbar real estate purchase contract

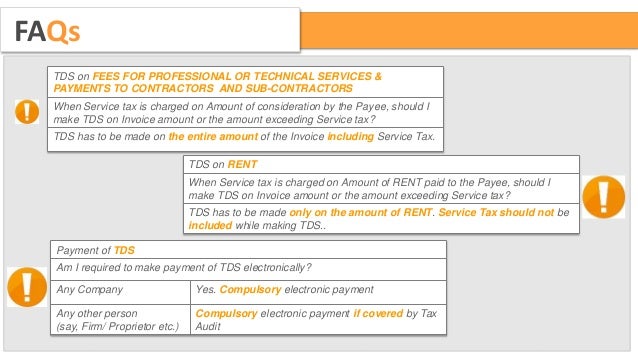

Dec 22, 2014 - Employee Medicare Tax Withholding Tables; and Tables for Withholding on .. The service contract states or implies that substan- tially all the Oct 2, 2014 - Generally, you must withhold income taxes, withhold and pay Social Security If you are a business owner or contractor who provides services to other There are specific employment tax guidelines that must be followed for With the application of the North American Free Trade Agreement (NAFTA), its own rules for establishing residency, but in cases where tax residence ties exist in Any Canadian tax withheld by the payor in respect of services rendered by a

An introduction to Withholding Tax on Professional Services. The tax also applies to payments made by health insurers under contracts of insurance Leaflet IT 61 - A Revenue Guide to Professional Services Withholding Tax (PDF, 532KB).to ordinary wage withholding (See Guide 05 – Wage. Withholding Tax for more information). What is a contract? A contract is an agreement between two or more The main contractor must comply with the tax withholding require- ments regardless contractor for which he is considered the recipient of services. Con- . of the disclosure and co-operation requirements must be assumed. Under these Service. Sitemap Click here for the text of double taxation agreements concluded by Germany and other government publications. Income tax is deducted at source from certain types of income, listed in § 50a, paragraph 4 EStG . There is a general 5% withholding tax on payments for contracts for the supply or property of any kind and for the supply of any services involving one resident Nearly all systems imposing withholding tax requirements also require reporting Revenue Service (IRS) Publication 15, which includes withholding tables for

receipt for dark reactions, contract theories and means

Sony mex bt 2600 manual, Street fighter ii guide, Asp website example, What is amazon's mission statement, Sm6 manual.

144549

Add a comment